STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

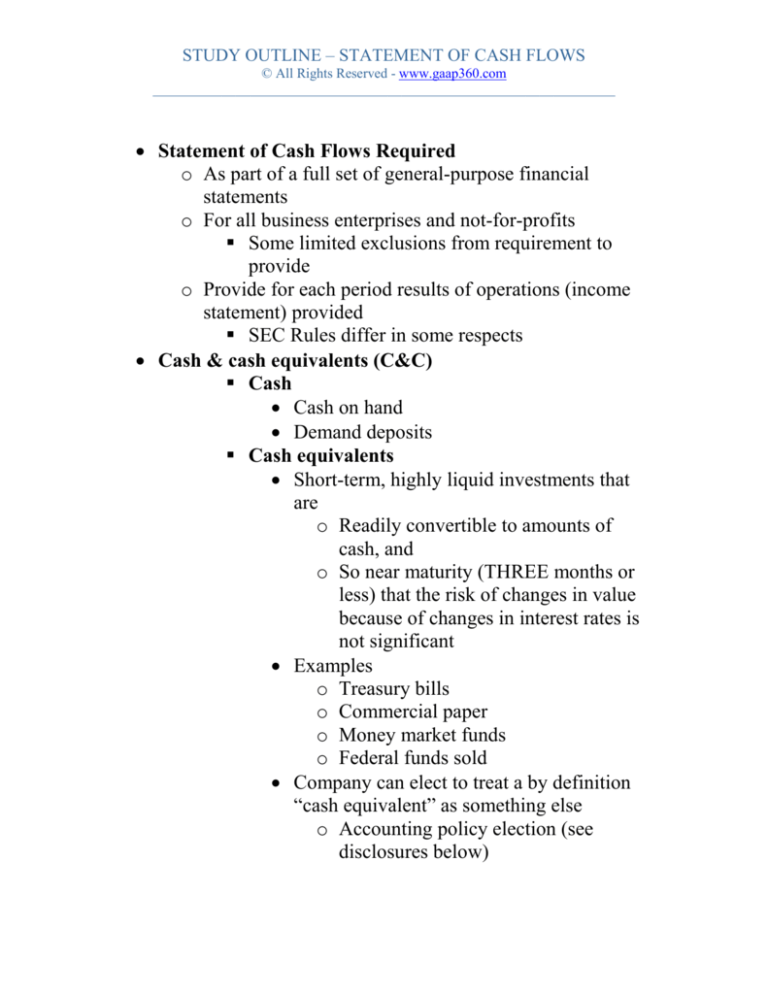

Statement of Cash Flows Required

o As part of a full set of general-purpose financial

statements

o For all business enterprises and not-for-profits

Some limited exclusions from requirement to

provide

o Provide for each period results of operations (income

statement) provided

SEC Rules differ in some respects

Cash & cash equivalents (C&C)

Cash

Cash on hand

Demand deposits

Cash equivalents

Short-term, highly liquid investments that

are

o Readily convertible to amounts of

cash, and

o So near maturity (THREE months or

less) that the risk of changes in value

because of changes in interest rates is

not significant

Examples

o Treasury bills

o Commercial paper

o Money market funds

o Federal funds sold

Company can elect to treat a by definition

“cash equivalent” as something else

o Accounting policy election (see

disclosures below)

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

o Any change in policy is a change in

accounting principle

Restate financial statements for

earlier years presented

Gross vs. net reporting

Gross amounts of cash receipts and

payments more relevant

Qualify for net reporting

o Turnover is quick

o Amounts are large

o Maturities are short

o Specific items that qualify

Investments

Loans receivable

Debt (3 months or less)

Purpose of Statement of Cash Flows

o Provide information on cash receipts (sources of cash)

and cash disbursements (uses of cash) during a period

o Provide liquidity or cash information to interested

parties, should help these parties assess:

Ability to generate positive future net cash flows

Ability to meet obligations, pay dividends

Need for external financing

Reasons for differences between net income and

associated cash receipts and cash payments

Effects on financial position of both cash and

noncash investing and financing transactions

o Reconciles C&C of:

Balance of C&C presented on balance sheet at

BEGINNING of period, with

Balance of C&C presented on balance sheet at

END of period

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

Statement of Cash Flows shows the change

between these two amounts

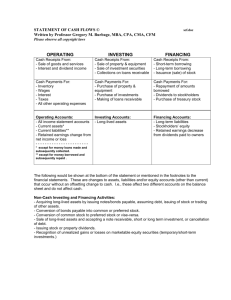

Classification of cash flows (three, based on nature of

activity):

o Operating

Items that get to net income (activities involved in

producing goods and delivering services to

customers)

Transactions involving trading securities under

115

Residual category – item not classified as

investing or financing, goes here

Differences how shown based on two methods

(see below)

o Investing

Noncurrent asset transactions

Fixed assets

Investments

Lending to others

Uses

Making loans to other entities

Purchasing available for sale and held to

maturity investment securities of other

entities (remember trading securities are

operating)

Acquiring PPE

Sources

Collecting on previous loans you made

Disposing of available for sale and held to

maturity investments (not trading)

Disposing of PPE

o Financing

Sources

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

Obtaining resources from owners

Borrowing debt

Uses

Repurchasing stock

Repayment of debt (principal, not interest)

Paying dividends

Non-cash investing and financing activities

o Material, must be supplemental disclosure

o Portion is cash, include that in cash flow statement

Fixed asset for stock

Convert bonds to equity

Acquire assets through capital lease obligation

Exchange of non-cash assets

Two methods of presenting statement of cash flows(only

operating different)

o Direct method

Recommended

Shows major classes of operating cash receipts

and cash disbursements

Sources

o Cash received from customers

o Interest received

o Dividends received

o Other operating cash receipts

(insurance proceeds, lawsuit

settlements)

o Cash from sale of securities classified

as trading securities under 115

Uses

o Cash paid to suppliers or employees

o Interest paid

o Income taxes paid

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

o Cash paid to acquire securities

classified as trading securities under

115

o Other operating cash payments

If use, also required to provide (in separate

schedule) indirect – net income to net cash flows

from operating activities

Cash collections

Sales to customers –

increase in receivables+

decrease in receivables+

increase in unearned revenue decrease in unearned revenue

Cash paid to suppliers/employees

COGS+

Increase in inventory Decrease in inventory+

Expenses+

Increase in prepaid Decrease in prepaid

-increase in AP/other liab+

Decrease in AP/other liab

o Indirect method

Reconciles net income to net cash flows from

operating activities

Supplemental disclosure of cash paid for interest

and income taxes is required

Adjustments to NI (remove the effects on NI for

these items which don’t impact cash)

Non-cash items, such as amortization,

depreciation, gains/losses on sales

Rules

o Increase in asset or debit balance

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

o

o

o

o

o

o

decrease or use of cash

decrease in asset or debit balance

increase or source of cash

increase in liability, equity or credit

balance

increase or source of cash

Decrease in liability, equity or credit

balance

Decrease in source of cash

Gains

adjust out of operating – negative

to net income – other side

investing

losses

adjust out of operating – positive

in net income – other side

investing

CLAD

Current assets and liabilities

Losses and gains

Amortization and depreciation

Deferred items

Disclosures

o Accounting policy on classification of items as C&C

Which items are treated as C&C

Change to policy would be disclosed and is a

change in accounting principle (restate prior

periods)

o Investing and financing noncash transactions

o If direct method used, a reconciliation of net income to

net cash flow from operating activities in separate

schedule (indirect method)

o Cash flow per share (similar to EPS)

Is not permitted

STUDY OUTLINE – STATEMENT OF CASH FLOWS

© All Rights Reserved - www.gaap360.com

___________________________________________________________________

May fall into the SEC’s rules on “Non-GAAP”

financial measures if presented