Name

advertisement

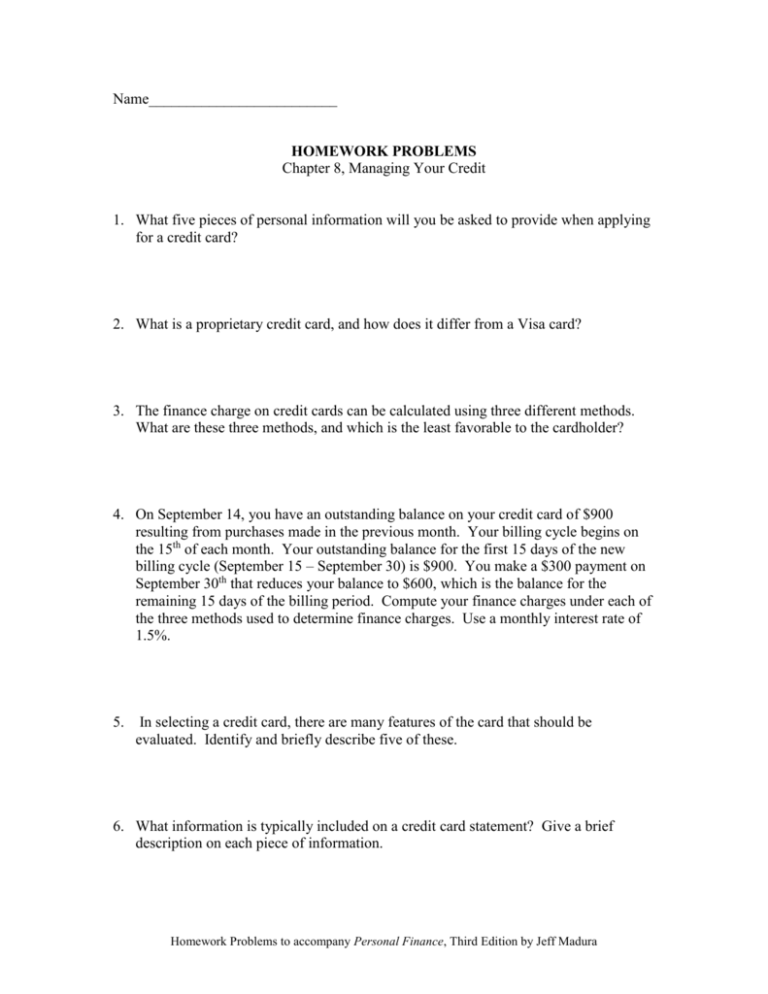

Name_________________________ HOMEWORK PROBLEMS Chapter 8, Managing Your Credit 1. What five pieces of personal information will you be asked to provide when applying for a credit card? 2. What is a proprietary credit card, and how does it differ from a Visa card? 3. The finance charge on credit cards can be calculated using three different methods. What are these three methods, and which is the least favorable to the cardholder? 4. On September 14, you have an outstanding balance on your credit card of $900 resulting from purchases made in the previous month. Your billing cycle begins on the 15th of each month. Your outstanding balance for the first 15 days of the new billing cycle (September 15 – September 30) is $900. You make a $300 payment on September 30th that reduces your balance to $600, which is the balance for the remaining 15 days of the billing period. Compute your finance charges under each of the three methods used to determine finance charges. Use a monthly interest rate of 1.5%. 5. In selecting a credit card, there are many features of the card that should be evaluated. Identify and briefly describe five of these. 6. What information is typically included on a credit card statement? Give a brief description on each piece of information. Homework Problems to accompany Personal Finance, Third Edition by Jeff Madura 7. Given the following information, what must you pay to avoid any future finance charges on your credit card? Your previous balance is $950. This balance is subject to annual interest charges of 12% using the previous balance method. During the month you made purchases of $600 and cash advances of $300 subject to 1% charges. You made payments during the current billing cycle of $400. 8. When comparing credit cards, what four items should you consider? Briefly discuss each. 9. If properly used, credit cards can be a valuable tool in managing your liquidity. List and discuss at least five tips for proper use of credit cards. 10. What steps should you take if you find yourself with excessive balances on your credit cards? Homework Problems to accompany Personal Finance, Third Edition by Jeff Madura