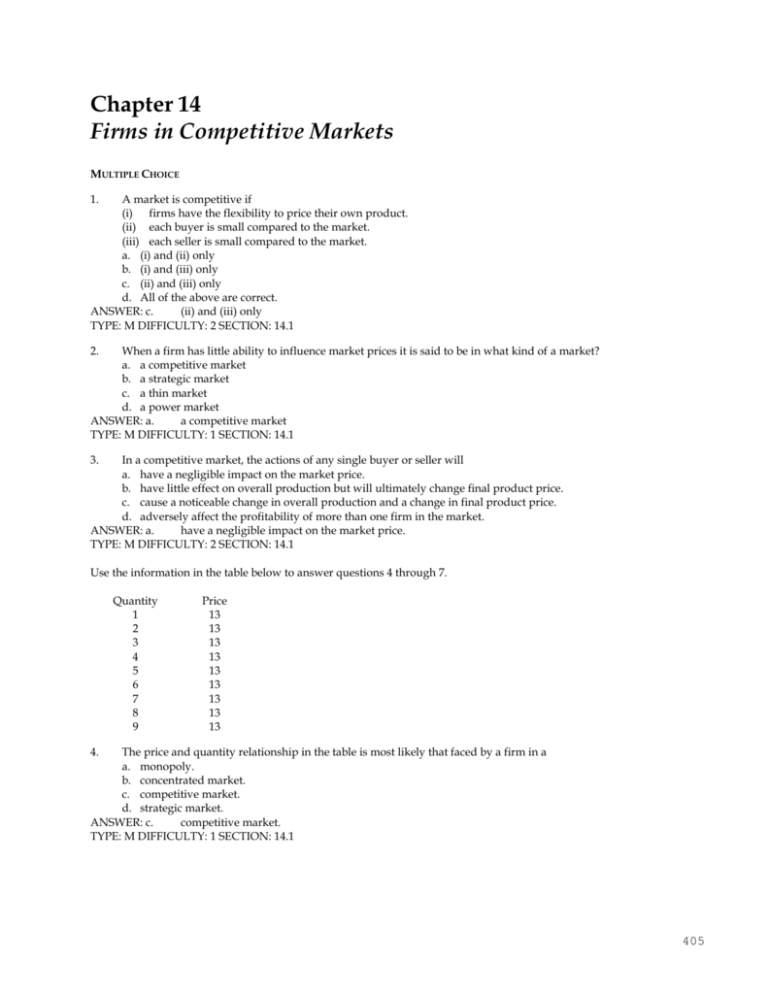

Chapter 14

advertisement