CA CALIFORNIA

advertisement

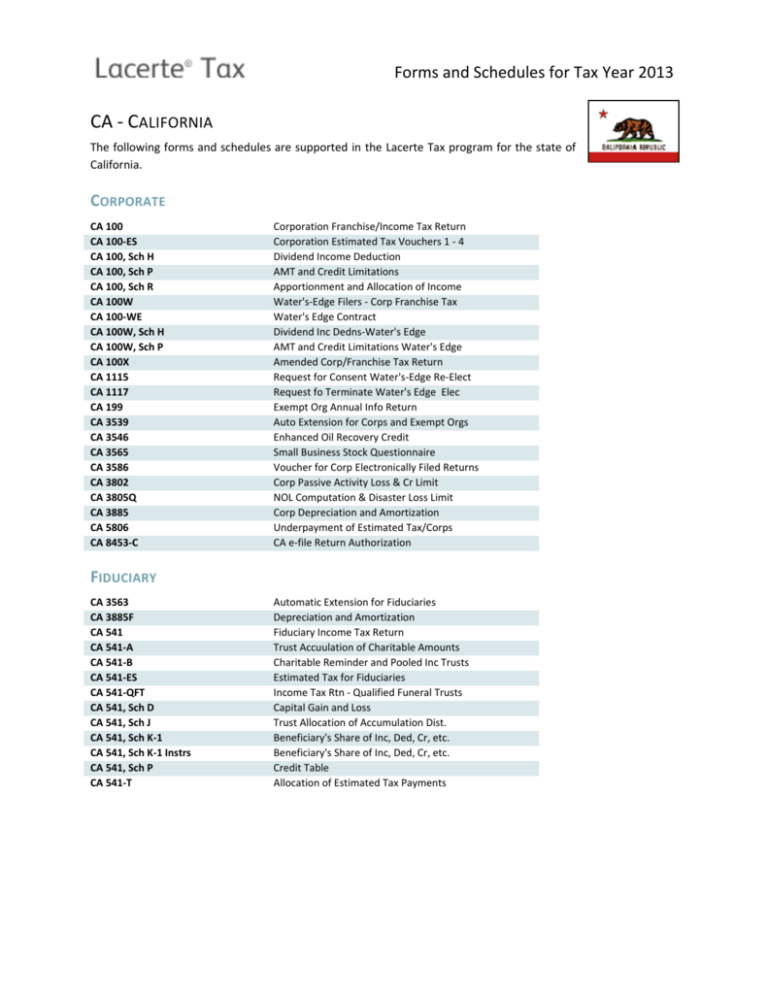

Forms and Schedules for Tax Year 2013 CA - CALIFORNIA The following forms and schedules are supported in the Lacerte Tax program for the state of California. CORPORATE CA 100 CA 100-ES CA 100, Sch H CA 100, Sch P CA 100, Sch R CA 100W CA 100-WE CA 100W, Sch H CA 100W, Sch P CA 100X CA 1115 CA 1117 CA 199 CA 3539 CA 3546 CA 3565 CA 3586 CA 3802 CA 3805Q CA 3885 CA 5806 CA 8453-C Corporation Franchise/Income Tax Return Corporation Estimated Tax Vouchers 1 - 4 Dividend Income Deduction AMT and Credit Limitations Apportionment and Allocation of Income Water's-Edge Filers - Corp Franchise Tax Water's Edge Contract Dividend Inc Dedns-Water's Edge AMT and Credit Limitations Water's Edge Amended Corp/Franchise Tax Return Request for Consent Water's-Edge Re-Elect Request fo Terminate Water's Edge Elec Exempt Org Annual Info Return Auto Extension for Corps and Exempt Orgs Enhanced Oil Recovery Credit Small Business Stock Questionnaire Voucher for Corp Electronically Filed Returns Corp Passive Activity Loss & Cr Limit NOL Computation & Disaster Loss Limit Corp Depreciation and Amortization Underpayment of Estimated Tax/Corps CA e-file Return Authorization FIDUCIARY CA 3563 CA 3885F CA 541 CA 541-A CA 541-B CA 541-ES CA 541-QFT CA 541, Sch D CA 541, Sch J CA 541, Sch K-1 CA 541, Sch K-1 Instrs CA 541, Sch P CA 541-T Automatic Extension for Fiduciaries Depreciation and Amortization Fiduciary Income Tax Return Trust Accuulation of Charitable Amounts Charitable Reminder and Pooled Inc Trusts Estimated Tax for Fiduciaries Income Tax Rtn - Qualified Funeral Trusts Capital Gain and Loss Trust Allocation of Accumulation Dist. Beneficiary's Share of Inc, Ded, Cr, etc. Beneficiary's Share of Inc, Ded, Cr, etc. Credit Table Allocation of Estimated Tax Payments Forms and Schedules for Tax Year 2013 INDIVIDUAL CA 3501 CA 3506 CA 3510 CA 3516 CA 3519 CA 3520 CA 3521 CA 3523 CA 3526 CA 3527 CA 3533 CA 3540 CA 3547 CA 3548 CA 3567 CA 3582 CA 3800 CA 3801 CA 3801-CR CA 3803 CA 3805E CA 3805P CA 3805V CA 3805Z CA 3885A CA 4803e CA 540 CA 540 2EZ CA 540-ES CA 540NR-Long CA 540NR, Sch CA CA 540NR, Sch D CA 540NR, Sch P CA 540NR-Short CA 540, Sch CA CA 540, Sch D CA 540, Sch P CA 540, Sch S CA 540-V CA 540X CA 5805 CA 5805F CA 5805 Worksheets CA 5870A CA 592-B 2009 CA 592-B 2013 CA 8453 CA 8454 CA 8455 CA 8879 CA EF Consent to Disclose Employer Child Care Prog/Contrib Credit Child & Dependent Care Expenses Credit Credit for Prior Year Alt Min Tax Request Copy Personal/Fiduciary Return Payment for Automatic Extension - Indiv Power of Attorney Low-Income Housing Credt Research Credit Investment Interest Expense Deduction New Jobs Credit Change of Address Credit Carryover Summary Donated Agricultural Prod Trans Credit Disabled Access Credit for Eligible Business Installment Agreement Request Payment Voucher for Individual e-filed Returns Tax Computation Child w/Investment Income Passive Activity Loss Limitations Passive Activity Credit Limitations Election to Report Child's Int & Div Installment Sale Income Return for IRA and Qualifying Retire Plan Net Operating Loss (NOL) Computation Enterprise Zone Dedn and Credit Summary Depreciation and Amortization Adjmnts Head of Household Schedule California Resident Income Tax Return California Resident Income Tax Return EZ Estimated Tax for Individuals Non/PY Resident Income Tax Rtn - Long California Adjustments - NR or PY Residents Capital Gain or Loss Adjustment Alternative Minimum Tax - NR or PY Non/PY Resident Income Tax Rtn - Short California Adjustments - Residents Capital Gain or Loss Adjustment Alternative Minimum Tax - Residents Other State Tax Credit Payment Voucher for 540 Returns Amended Individual Income Tax Return Underpayment of Estimated Tax by Ind and Fid Underpayment by Farmers and Fishermen 5805 Worksheets Tax on Accumulation Distribution of Trusts Resident and Nonresident WH Tax Statement Resident and Nonresident WH Tax Statement e-file Return Authorization for Individuals e-file Opt-Out Record for Individuals e-file Payment Record for Individuals e-file Signature Authorization for Individuals Tax Return Signature/Consent to Disclosure Forms and Schedules for Tax Year 2013 CA Sch D-1 CA Sch G-1 CA Sch W-2 CG Sales of Business Property Tax on Lump-Sum Distributions Wage and Withholding Summary LLC CA 3522 CA 3536 CA 3537 CA 3588 (e-file) CA 3832 CA 3885L CA 568 CA 568, LLC Worksheet CA 568, Sch D CA 568, Sch K-1 CA 568, Sch K-1 Instrs Limited Liability Company Tax Voucher Estimated Fee for LLCs Automatic Extension for LLCs Voucher for LLC e-filed Returns Limited Liability Company Members List Depreciation and Amortizaion Limited Liability Co. Return of Income Limited Liability Co. Income Worksheet Capital Gain or Loss Members Share of Inc/Ded/Credit etc. Members Share of Inc/Ded/Credit etc. OTHER CA 109 CA RRF-1 Exempt Organization Business Income Tax Registration/Renewal Fee Report PARTNERSHIP CA 3538 CA 3587 (e-file) CA 3885P CA 565 CA 565, Sch D CA 565, Sch K-1 CA 565, Sch K-1 Instrs CA 592 CA 592-A Vouchers CA 592-A Worksheet CA 592-V CA 8453-LLC CA 8453-P Auto Extension for LPs, LLPs, & REMICs Voucher for LP, LLP, and REMIC e-file Depreciation and Amortization Partnership Return of Income Capital Gain or Loss Partner's Share of Inc/Deductions/Credits Partner's Share of Inc/Deductions/Credits Res/NR Withholding Stmt Withholding Remittance Stmts Installment Payment Worksheet Payment Voucher for Res/NR WH CA e-file Return Auth for LLC CA e-file Return Auth for Partnerships S CORP CA 100S CA 100S, Sch B CA 100S, Sch C CA 100S, Sch D CA 100S, Sch H CA 100S, Sch K-1 CA 100S, Sch K-1 Instrs CA Sch QS S Corporation Franchise/Income Tax Return S Corporation Depreciation & Amortization S Corporation Tax Credits Capital Gains/Losses & Built-In Gains S Corp Dividend Income Shareholders' Share of Inc/Credit/Ded Shareholders' Share of Inc/Credit/Ded Qual Subchapter S Sub Info Wkst