Chapter 17: ANSWERS TO "DO YOU UNDERSTAND" TEXT

advertisement

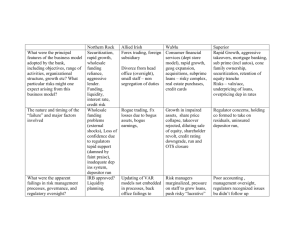

Chapter 17: ANSWERS TO "DO YOU UNDERSTAND" TEXT QUESTIONS DO YOU UNDERSTAND? 1. When and why were the various types of thrift institutions started in the United States? Solution: They were all started because commercial banks initially did not provide for the needs of consumers with small deposits. In addition, commercial banks initially made primarily commercial loans, not mortgage loans or consumer loans. The mutual savings banks were started in 1816 to provide a safe place for people to accumulate small amounts of savings. The savings and loan associations started as building societies in 1831 to help people finance home construction. 2. Name the present federal regulators of savings institution institutions. Also, explain which ones no longer exist and why. Solution: The present deposit insurers are the FDIC-BIF and the FDIC-SAIF. The present regulator of federal savings associations is the OTS, while the FDIC regulates most federally-insured and chartered savings banks. State regulators regulate statechartered savings banks and savings and loan associations, also. The federal regulators that have been liquidated are the FHLBB and the FLSIC, closed in 1989 because they let too many savings associations get in financial trouble while they looked the other way and used lax regulatory accounting principals (RAP). In addition, the RTC was closed in 1995 after it liquidated all the problem thrift institutions and their remaining assets. The RTC was started in 1989 when the thrift industry and its regulators were restructured by the FIRRE Act in 1989, and it completed its job of liquidating problem savings institutions and their assets in 1995. 3. What are savings institutions’ most important assets and liabilities? Solution: 1–4 family (home) mortgage loans and savings deposit accounts, including savings certificates. 4. What trends have recently occurred in savings associations’ capital adequacy, earnings, and numbers, and why? Solution: Capital adequacy has trended upward as weak thrifts have been liquidated, interest rate spreads have widened with low interest rates in the last few years, losses have declined on bad assets, and earnings have improved. The number of thrifts has declined through merger, conversion to bank charters, acquisitions of thrifts by banks, and liquidation of weak institutions by the RTC. DO YOU UNDERSTAND? 1. What are credit unions' most important assets and liabilities? Solution: Credit unions’ most important assets are auto and real estate secured loans and investment security and deposit holdings. Their most important liabilities are members’ savings share regular deposits and certificates of deposit. 2. Why is the credit union common-bond requirement changing? How, and why is it changing? Solution: The credit union common bond requirement is that all members of a credit union should have some common characteristic (employer; church, professional, or union affiliation; or, occasionally, residential location). It is changing by allowing people who belong to groups with different identifying characteristics to cluster together in a single credit union. It also has been extended by allowing retiree groups to join credit unions, by allowing family members to join credit unions, and to let members always retain their membership once they have joined even if they no longer share the unifying common characteristic after they change jobs or move, etc. The motivating factor behind most changes is that credit unions are often small and a restrictive interpretation of their common bond would keep them that way. Small credit unions often cannot gain from economies of scale and cannot afford to offer sophisticated services to their members unless they find a way to grow and expand their membership numbers. Thus, they are motivated to extend their common bonds in order to reduce costs and offer more sophisticated financial services to their members. 3. How does the common-bond requirement affect credit unions’ credit risk? Solution: The common-bond requirements prevents wide-spread diversification needed for share drafts and loans. Credit unions have difficulties when strikes, plant closing, churches fail, etc., which would not be a problem if they could market to the general public. DO YOU UNDERSTAND? 1. What types of finance companies exist and what does each do? Solution: Consumer finance companies primarily make loans to consumers. Sales finance companies primarily finance sales made by retail dealers by buying the credit contracts (customer paper) generated by those sales. Captive finance companies are sales finance companies that were started to finance the sales of their parent companies’ goods and services. Factors finance business firms by buying and collecting their accounts receivable. Business finance companies finance business loan needs in general. Leasing companies purchase goods or equipment desired by their customers and lease the goods to their customers. 2. How do finance companies fund their operations? Solution: Most have lines of credit at commercial banks, and the larger finance companies issue commercial paper to obtain short-term funding. They also issue long-term debt and captive finance companies can borrow from, or obtain “transfer credit,” from their parents. 3. Why are good credit ratings important to finance companies? Solution: Because they generally do not issue insured liabilities. Thus, in order to reduce their funding costs to the lowest possible level, they must have the best credit ratings possible. In addition, in order to be sure that they can obtain liquidity when needed, they must maintain good credit ratings so they can obtain funds when necessary. 4. What regulations have caused finance companies to de-emphasize their unsecured personal lending? Solution: Restrictions on creditors’ collection remedies has made it more difficult to obtain repayment on unsecured consumer loans. In addition, restrictions on the seizure of collateral under liberalized bankruptcy laws passed in 1978 have made it more difficult to seize collateral or collect in full on defaulted debts. Furthermore, restrictions on rate ceilings have made it difficult to make a profit on small consumer loans. Thus, finance companies have switched to making larger, better-secured loans, such as second-mortgage-secured home-equity lines of credit instead of small individual personal loans.