Corporate Finance Midterm Test Date and Time: 9:05

advertisement

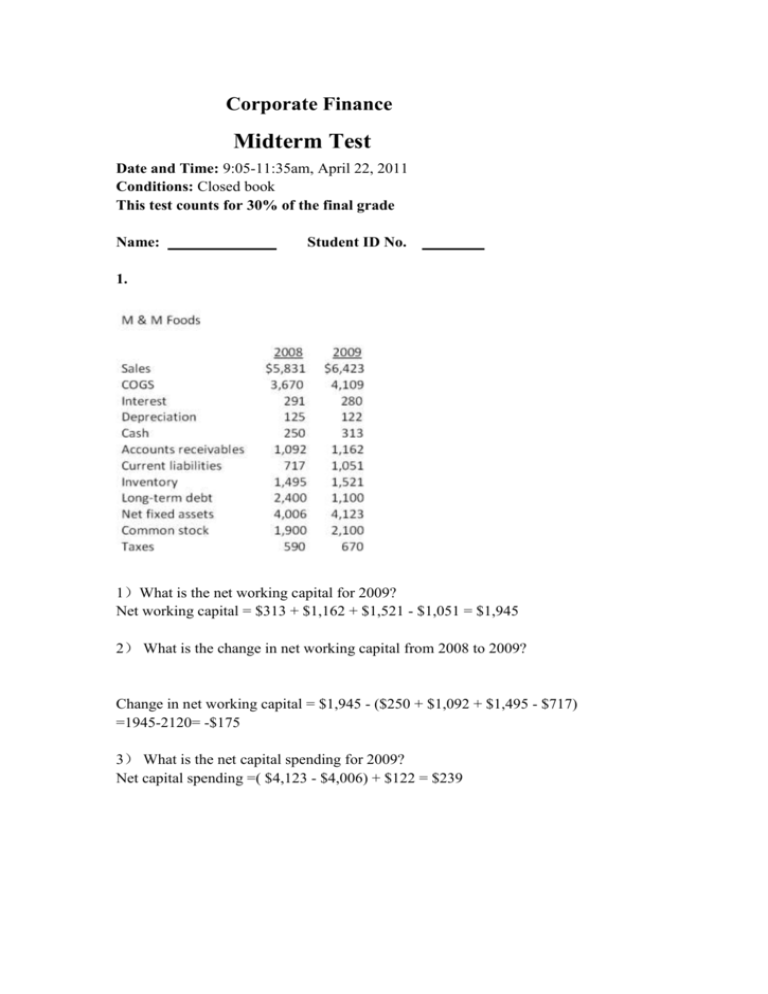

Corporate Finance

Midterm Test

Date and Time: 9:05-11:35am, April 22, 2011

Conditions: Closed book

This test counts for 30% of the final grade

Name:

Student ID No.

1.

1)What is the net working capital for 2009?

Net working capital = $313 + $1,162 + $1,521 - $1,051 = $1,945

2) What is the change in net working capital from 2008 to 2009?

Change in net working capital = $1,945 - ($250 + $1,092 + $1,495 - $717)

=1945-2120= -$175

3) What is the net capital spending for 2009?

Net capital spending =( $4,123 - $4,006) + $122 = $239

4) What is the operating cash flow for 2009?

Operating cash flow = ($6,423 - $4,109 - $122) + $122 - $670 = $1,644

5) What is the cash flow from assets for 2009?

Cash flow from assets = Operating cash flow- Change in net working capital- Net

capital spending=-$1,644 - $239 - (-$175) = $1,580

6) What is net new borrowing for 2009?

Net new borrowing = $1,100 - $2,400 = -$1,300

7)What is the cash flow to creditors for 2009?

Cash flow to creditors = 280 - (-$1,300) = $1,580

8) What is the cash flow to stockholders for 2009?

Cash flow to stockholders = Cash flow from assets- Cash flow to creditors =$1,580 $1,580 = $0

2.

1) What is the quick ratio for 2009?

Quick ratio=(3650-2360)/1920=67.19%

2). How many days of sales are in receivables? (Use 2009 values)

Accounts receivable turnover for 2009 = $17,300/$940 = 18.4

Days' sales in receivables for 2009 = 365/ 18.4=19.84

3) Hungry Howie's is currently operating at 78 percent of capacity. What is the

full-capacity level of sales?

Full-capacity sales = $17,300/0.78 = $22,179.49

4) Hungry Howie's is currently operating at 82 percent of capacity. What is the total

asset turnover ratio at full capacity?

Full-capacity sales = $17,300/0.82 = $21,097.56

Total asset turnover at full-capacity = $21,097.56/$14,500 = 1.46

5) Hungry Howie's is currently operating at 96 percent of capacity. The profit margin

and the dividend payout ratio are projected to remain constant. Sales are projected to

increase by 3 percent next year. What is the projected addition to retained earnings for

next year?

Projected addition to retained earnings = $1,380 (1 + .03) = $1,421.40

6) Hungry Howie's is currently operating at full capacity. The profit margin and the

dividend payout ratio are held constant. Net working capital and fixed assets vary

directly with sales. Sales are projected to increase by 11 percent. What is the external

financing needed?

Projected total assets = $14,500 1.11 = $16,095

Projected accounts payable = $1,920 1.11 = $2,131.20

Projected retained earnings = $1,580 + ($1,380 1.11) = $3,111.80

External financing need = $16,095 - $2,131.20 - $3,500 - $7,500 - $3,111.80 = -$148

7) Hungry Howie's maintains a constant payout ratio. The firm is currently operating

at full capacity. What is the maximum rate at which the firm can grow without

acquiring any additional external financing?

Internal growth = [($1,830/$14,500) ($1,380/$1,830)]/{1 - [($1,830/$14,500)

($1,380/$1,830)]} = 10.52 percent

8) Identify the four primary determinants of a firm's growth and explain how each

factor could either add to or limit the growth potential of a firm.

The four factors are:

3. Frasier Cabinets wants to maintain a growth rate of 5 percent without incurring

any additional equity financing. The firm maintains a constant debt-equity ratio of

.0.55, a total asset turnover ratio of 1.30, and a profit margin of 9.0 percent. What

must the dividend payout ratio be?

Return on equity = 0.09 1.30 (1 + 0.55) = 0.18135

Sustainable growth = [0.18135 b]/[1 - (0.18135 b)] = .05; b = 0.2626

Payout ratio = 1 - 0.2626 = 73.74 %

4. Oil Well Supply offers 7.5 percent coupon bonds with semiannual payments and a

yield to maturity of 7.68 percent. The bonds mature in 6 years. What is the market

price per bond if the face value is $1,000?

基础题目,半年期

5.

Jen's Fashions is growing quickly. Dividends are expected to grow at a 22

percent rate for the next 3 years, with the growth rate falling off to a constant 8

percent thereafter. The required return is 12 percent and the company just paid a $3.80

annual dividend. What is the current share price?