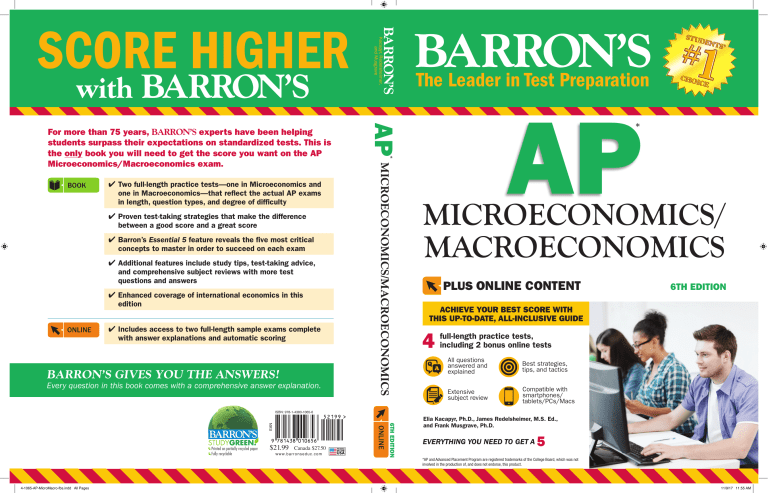

Barrons AP MicroeconomicsMacroeconomics with Bonus Online Tests 6th Edition

advertisement