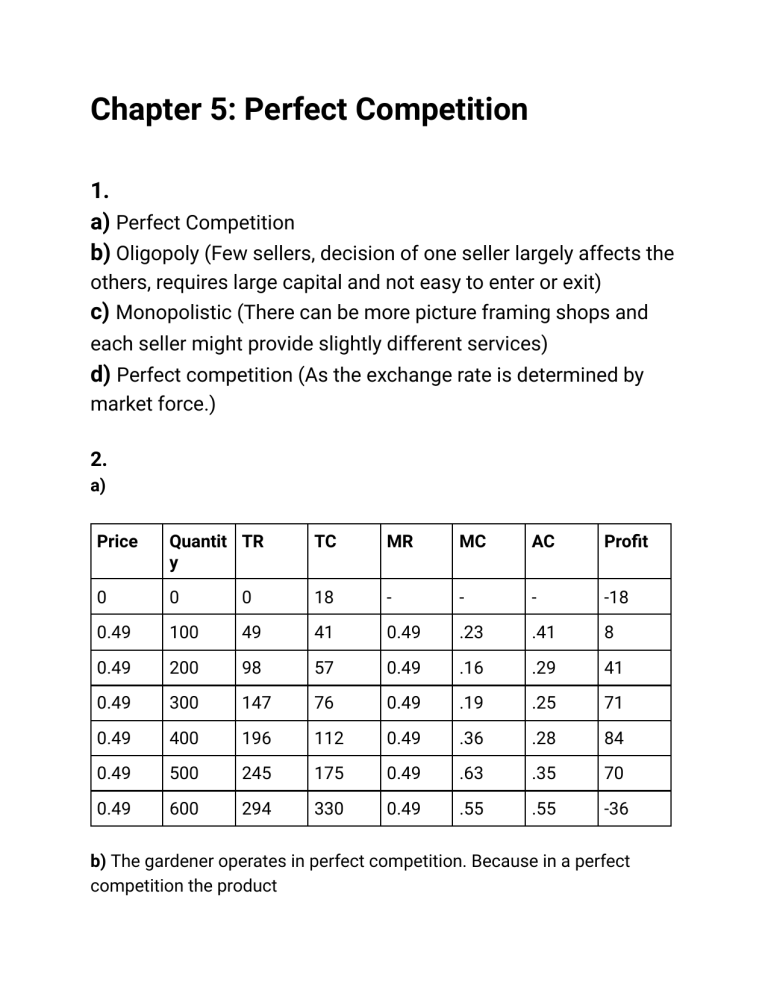

Chapter 5: Perfect Competition 1. a) Perfect Competition b) Oligopoly (Few sellers, decision of one seller largely affects the others, requires large capital and not easy to enter or exit) c) Monopolistic (There can be more picture framing shops and each seller might provide slightly different services) d) Perfect competition (As the exchange rate is determined by market force.) 2. a) Price Quantit TR y TC MR MC AC Profit 0 0 0 18 - - - -18 0.49 100 49 41 0.49 .23 .41 8 0.49 200 98 57 0.49 .16 .29 41 0.49 300 147 76 0.49 .19 .25 71 0.49 400 196 112 0.49 .36 .28 84 0.49 500 245 175 0.49 .63 .35 70 0.49 600 294 330 0.49 .55 .55 -36 b) The gardener operates in perfect competition. Because in a perfect competition the product is standard with many close substitutes. And here the demand curve of the market structure is perfectly elastic meaning at one price quantity demanded is adjusted. Also we can see the table from “a” that Average Revenue/ price = marginal cost which refers to the characteristics of perfect competition. c) d) The profit maximizing or loss minimizing quantity is where marginal cost = marginal revenue. Based on the table, the quantity is around 400 kg when profit is 84. 3. a) (3) TR (6) TC (7) AFC (8) AVC (9) AC (10) MC 0 254 63 304 2.82 0.56 3.38 0.56 119 324 1.49 0.41 1.91 0.25 182 371 0.98 0.45 1.43 0.52 210 403 0.85 0.50 1.34 0.80 238 492 0.75 0.70 1.45 2.23 b) c) The profit-maximizing quantity of output is 260 since at this quantity the MR = MC. Again, the firm is facing a loss of $190 ($182-$372) since the AC is higher than the MR. d) Breakeven point: At Quantity 300 because at that point the AC is the lowest Shutdown point: At quantity 340 because at that point the Price/MR = AVC OR TR = VC e) The business supply curve is the mc curve above the point where MC and MR intersects f) As the business progresses by increasing its output, the TR will increase but will be below the VC as as the last quantity stated the TR = VC. So eventually the business has to shut down. 4. a) 1 Price 3 TR 4 FC 6 TC 7 AFC 8 AVC 9 AC 10 MC 4 0 100 100 - - - 4 100 100 210 4 4.4 8.4 4.4 4 248 100 262 1.62 2.61 4.22 1.41 4 320 100 320 1.25 2.75 4 3.22 4 440 100 480 0.9 3.45 4.35 3.33 4 560 100 800 0.71 5 3.71 10.67 b) c) At 110 quantity. Loss of $40 d) The firm cant stay in the business in long run as the tr drops below the vc 5. a) 1 2 3 Price Quan TR 4 Fc 5 VC 6 TC 7 AFC 8 AVC 9 AC 10 MC 15 0 0 1500 0 1500 15 200 3000 1500 1700 3200 7.5 8.50 16 8.5 15 400 6000 1500 3000 4500 3.7 7.50 11.25 6.5 15 600 9000 1500 4700 6200 2.5 7.83 10.33 8.5 15 800 12000 1500 7100 8600 1.88 8.88 10.76 12 15 1000 15000 1500 10700 12200 1.5 10.7 12.20 18 b) c) Profit maximizing output: 800 Profit: 3400 d) At every point TR is higher than VC so the business will sustain in the long run. 6. a) Equilibrium price: $2.00 Equilibrium quantity: 60 If this represents long run equilibrium in the market, there will be no economic profit as marginal cost will surpass the price. b) Price D0 D1 S0 3.00 40 20 80 2.50 50 30 70 2.00 60 40 60 1.50 70 50 50 1.00 80 60 40 c) 7. In the context of firms and production, minimum cost pricing refers to the idea that firms seek to minimize their production costs to maximize profits. The invisible hand operates here as firms, driven by the profit motive, strive to produce goods and services at the lowest possible cost. Competition in the market encourages firms to innovate, find cost-effective production methods, and utilize resources efficiently. Marginal cost is the additional cost incurred by producing one more unit of a good or service. In a competitive market, firms aim to set their prices equal to the marginal cost. The invisible hand is at work when firms adjust their production levels based on marginal cost. If the price is higher than the marginal cost, other firms can enter the market, increasing competition and driving prices down. Adam Smith's notion of the invisible hand, as articulated in "The Wealth of Nations," posits that individuals, driven by self-interest, unintentionally contribute to the overall economic well-being of society through market mechanisms. This concept finds resonance in the conditions of minimum cost and marginal cost pricing. Minimum cost pricing reflects the pursuit of profit maximization by firms, driving them to minimize production costs through innovation and efficient resource utilization. In the competitive market setting, marginal cost pricing aligns with the invisible hand as firms set prices equal to the marginal cost, ensuring efficient resource allocation. Both concepts emphasize self-interest, efficiency, and competition as essential elements in guiding economic decisions and resource allocation, providing a coherent framework in line with Adam Smith's vision of the invisible hand operating within a market-driven economy.