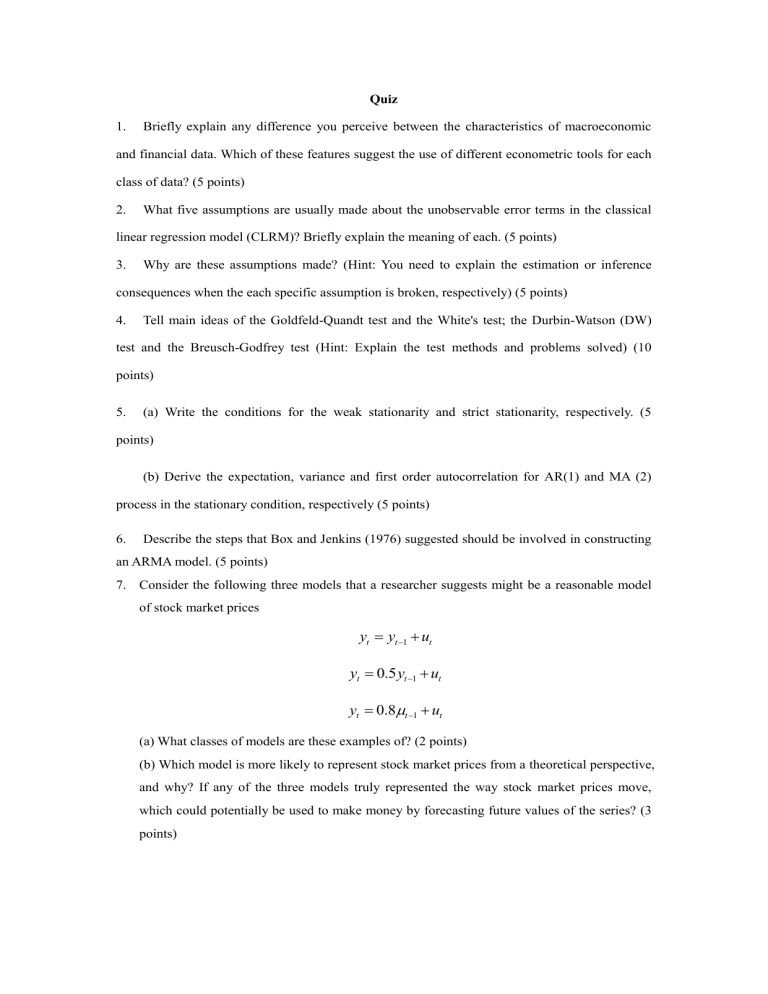

Quiz 1. Briefly explain any difference you perceive between the characteristics of macroeconomic and financial data. Which of these features suggest the use of different econometric tools for each class of data? (5 points) 2. What five assumptions are usually made about the unobservable error terms in the classical linear regression model (CLRM)? Briefly explain the meaning of each. (5 points) 3. Why are these assumptions made? (Hint: You need to explain the estimation or inference consequences when the each specific assumption is broken, respectively) (5 points) 4. Tell main ideas of the Goldfeld-Quandt test and the White's test; the Durbin-Watson (DW) test and the Breusch-Godfrey test (Hint: Explain the test methods and problems solved) (10 points) 5. (a) Write the conditions for the weak stationarity and strict stationarity, respectively. (5 points) (b) Derive the expectation, variance and first order autocorrelation for AR(1) and MA (2) process in the stationary condition, respectively (5 points) 6. Describe the steps that Box and Jenkins (1976) suggested should be involved in constructing an ARMA model. (5 points) 7. Consider the following three models that a researcher suggests might be a reasonable model of stock market prices yt yt 1 ut yt 0.5 yt 1 ut yt 0.8t 1 ut (a) What classes of models are these examples of? (2 points) (b) Which model is more likely to represent stock market prices from a theoretical perspective, and why? If any of the three models truly represented the way stock market prices move, which could potentially be used to make money by forecasting future values of the series? (3 points)