ACCTG833_2007_CHPT03D3.ppt

advertisement

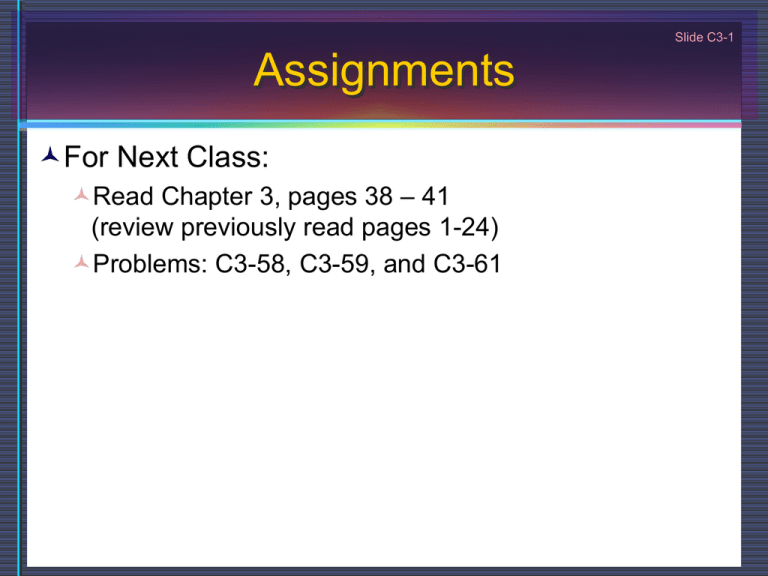

Slide C3-1 Assignments For Next Class: Read Chapter 3, pages 38 – 41 (review previously read pages 1-24) Problems: C3-58, C3-59, and C3-61 Chapter 3 The Corporate Income Tax Dividends-Received Deduction Slide C3-4 Dividends-Received Deduction Mitigates triple taxation of corporate income Deduction applies to: Dividends received by U.S. corporations from other U.S. Corporations [IRC §243(a)] Dividend must not be from a corporation that is taxexempt under IRC §501 [IRC §246(a)(1)] Slide C3-5 Dividends-Received Deduction Deduction percentages [IRC §243(a) & (c)] 70% DRD if ownership < 20% 80% DRD if 20% < ownership < 80% 100% DRD if 80% < ownership Slide C3-6 Dividends-Received Deduction Deduction is limited to a percentage of taxable income [IRC §246(b)(1)] 70% limit if DRD is 70% 80% limit if DRD is 80% Unlimited if DRD is 100% Slide C3-7 Dividends-Received Deduction [IRC §246(b)(1)] Limitation on DRD is based on taxable income calculated with: Charitable contributions deduction allowed Capital loss carryforwards allowed But without: Dividends-received deduction NOL carrybacks or carryforwards Capital loss carrybacks IRC §199 deduction Slide C3-8 Example 7: Charitable Contributions The XYZ Corporation has a $55,000 tax net operating loss carryforward from last year. In addition, the corporation reported the following income and expenses in its financial statements for the current year: Operating income Dividend income (15% owned companies) Charitable contributions Net income before taxes per books Contributions in excess of 10% limit $1,800,000 175,000 (300,000) $1,675,000 $108,000 Slide C3-9 Example 8: DRD Using the information from Example 7 above, what is the XYZ Corporation’s dividends-received deduction and taxable income before the IRC §199 deduction for the year? Answer: DRD = 175,000 x 70% = $122,500 Net income before taxes per books Add: Nondeductible contributions Total Limit 70% $1,675,000 108,000 $1,783,000 $1,248,100 Slide C3-10 Example 8: DRD Answer: Net income before taxes per books Add: Nondeductible contributions Less: DRD allowed Less: NOL carryforward Taxable income before IRC §199 deduction $1,675,000 108,000 (122,500) (55,000) $1,605,500 Slide C3-11 Dividends-Received Deduction Exception to the taxable income limitation: The taxable income limitation does not apply in years for which the DRD creates or contributes to a net operating loss [IRC §246(b)(2)] Slide C3-12 Example 9: DRD What amount of DRD and taxable income (before the IRC §199 deduction) does a C corporation have in each of the three independent situations below (the dividends are from companies that are less than 20% owned)? (a) (b) (c) Dividend income $50,000 $50,000 $50,000 Other taxable income 80,000 (10,000) (30,000) TI before DRD $130,000 $40,000 $20,000 Slide C3-13 Example 9: DRD (a) (b) (c) $50,000 80,000 $130,000 $50,000 (10,000) $40,000 $50,000 (30,000) $20,000 1. Dividend x 70% 2. TI x 70% DRD allowed $35,000 $91,000 $35,000 $35,000 $28,000 $28,000 $35,000 $14,000 $35,000 TI b/f IRC §199 $95,000 $12,000 $(15,000) Dividend Income Other Income TI before DRD Slide C3-14 Dividends-Received Deduction Exception: No DRD is allowed if the stock was held < 46 days during the 91-day period beginning 45 days before the ex-dividend date [IRC §246(c)(1)(A)] Short sales are treated similarly [IRC §246(c)(1)(B)] Slide C3-15 Example 10: DRD Purple Corp. purchases 500 shares of White Corp. on March 18th. White Corp. pays dividends of $10,000 to Purple Corp. on April 15th (the exdividend date was March 30th). Purple Corp. sold the 500 shares of White Corp. on April 28th. 45 days before March 30th is February 13th 91 days from February 13th is May 14th Purple Corp. gets no DRD since the stock was only held 42 days during the 91 day period Slide C3-16 Dividends-Received Deduction Exception: Dividends received deduction is reduced by the average indebtedness percentage if the stock portfolio is debt financed [IRC §246A(a)] Slide C3-17 Example 11: DRD The XYZ Corporation received $50,000 in dividends from U.S. corporations that are less than 20% owned. The average indebtedness on the corporations stock portfolio was 63%. What is the DRD allowed? Answer: $50,000 x 70% x (1 – 63%) = $12,950 Net Operating Loss Deduction Slide C3-19 Net Operating Losses Net operating losses NOL is the amount by which allowable deductions exceed taxable gross income [IRC §172(c)] NOLs are generally carried back 2 years and forward 20 years [IRC §172(b)] Election to waive carryback and carry forward only [IRC §172(b)(3)] Check the box on Form 1120 Election is irrevocable Slide C3-20 Example 12: NOL A C corporation had the following taxable income and taxes paid for the first three years of operations: Year 1 $91,000 ($20,550 in taxes paid) Year 2 $50,000 ($7,500 in taxes paid) Year 3 $120,000 ($30,050 in taxes paid) In the current year (Year 4), the corporation has a NOL of $(475,000). Taxable income for the next two years (before any NOL carryforwards) is projected to be: Year 5 $400,000 ($136,000 in taxes paid) Year 6 $600,000 ($204,000 in taxes paid) Assuming an 8% discount rate, should the corporation elect to waive the NOL carryback? Slide C3-21 Example 12: NOL Without election: TI before NOL NOL deduction TI after NOL Tax before NOL Tax after NOL Tax savings PV Factor PV of tax savings NPV of tax savings Year 2 Year 3 Year 5 $50,000 (50,000) $120,000 (120,000) $400,000 (305,000) $0 $0 $95,000 $7,500 0 $7,500 $30,050 0 $30,050 $136,000 20,550 $115,450 1.000 $7,500 $144,448 1.000 $30,050 0.9259 $106,898 Slide C3-22 Example 12: NOL With election: Year 5 Year 6 TI before NOL NOL deduction TI after NOL $400,000 (400,000) $0 $600,000 (75,000) $525,000 Tax before NOL $136,000 $204,000 Tax after NOL Tax savings PV Factor PV of tax savings 0 $136,000 0.9259 $125,926 178,500 $25,500 0.8573 $21,862 NPV of tax savings $147,788 IRC §199 Deduction Slide C3-24 U.S Production Activities Deduction IRC §199 was added October 2004 and is effective for tax years beginning after 2004 IRC §199(a) allows a deduction equal to a percentage of the lesser of: (1) qualified production activities income, or (2) taxable income before this deduction The percentages are: 3% for 2005-2006 6% for 2007-2009 9% beginning in 2010 Slide C3-25 U.S Production Activities Deduction Limitation: U.S. production activities deduction cannot exceed 50% of the corporation’s W-2 wages for the year [IRC §199(b)] Slide C3-26 U.S Production Activities Deduction Qualified production activities income is defined in IRC §199(c)(1) as: Domestic production gross receipts [IRC §199(c)(4)] Less: Allocable cost of goods sold Less: Other directly allocable deductions Less: Ratable portion of other deductions