Costs in Internatıonal Marketıng and Theır INCOTERMS n Product Prıcıng

advertisement

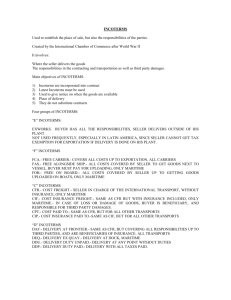

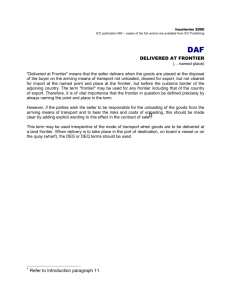

Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 INCOTERMS® Costs in Internatıonal Marketıng and Theır Effects on Product Prıcıng Yunus CERAN, Ali ALAGÖZ and Metehan ORTAKARPUZ Enterprises tend to welcome competitors and determine fair price by analysing all factors which have effects on price except for the items mentioned below while customers are interested in the last price of the product apart from service, quality, satisfaction and requirement level for the product put on market. Among the factors affecting price, the types of ® delivery terms (International Commercial Terms-Incoterms ) have a large share on the acquisition cost of products in international marketing for ® customers. That is why, it is necessary that the Incoterms provisions be known well, and that its costs be taken into consideration for international commercial products by enterprises. In this regard, this study dealt with approaches to product pricing, and also investigated effects of cost distribution between buyers and sellers on ® prices under the Incoterms rules. And exports from Turkey to both Russia ® and Brazilia were analyzed according to the Incoterms costs here. Key Words: International Marketing, Incoterms®, Incoterms® Costing, Product Pricing. 1. Introductıon Considering international trade processes is important of profitness and customer expectations in determining the price of a product to be presented in international market. In this regard, it requires foreign trade processes to be well-known, and cost, damage and risk responsibilities to be used in price determination. As it is known, foreign trade means a whole process from the sale offer to the arrival of goods to customers, from domestic trade to more risk and professional situations. Procedures in export and import customs, international shipment, insurance and payment systems are more extensive than domestic trade, and these are advanced process items of foreign trade. In determination of product sale prices in international marketing, risks and costs associated with international transportation are significant things. In accordance with customer demands and sale strategies, delivery types and delivery places of goods affect product price. Traditionally, the price which is determined by adding profit into costs of obtaining a product, is principally made in accordance with the internal market and transformed into the export price by adding international risks and costs in accordance with the types of delivery. Here, at this point, it is necessary to know the distributions of risk and responsibility associated with international delivery well, _________________ Yunus CERAN, Associate Professor Doctor, Selcuk University,Turkey. Email: yunusceran@selcuk.edu.tr Ali ALAGÖZ, Associate Professor Doctor, Selcuk University, Turkey. Email: alialagozs@gmail.com Metehan ORTAKARPUZ, Lecturer, Selcuk University, Turkey. Email: mortakarpuz@selcuk.edu.tr Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 in order to meet customers’ expectations on price and obtain competitive advantages on market in addition to the traditional and modern techniques of price determination. Understanding Incoterms® rules in foreign trade correctly and incompletely by firms has a vital importance of catching the most appropriate market price and managing commercial risks. In this study, Incoterms® rules will be put into consideration, and Incoterms® costs will be dealt in terms of exporters and importers. It has been researched to annwer the questions of how the costs given in accordance with the Incoterms® will affect the final price, which the delivery types will be acceptable in which situation. Also, focusing on the traditional and modern pricing approaches associated with the pricing process, it has been aimed to keep lights on enterprises exporting. 2. Internatıonal Marketıng and Reasons of Tendency Internatıonal Marketıng The purpose of marketing can be defined as bringing solutions to problems of possibly chosen customers, not selling goods. For a marketing staff, goods or service is an instrument for solving the customer’s problem. International marketing can be also defined as implementing one or more activities which exceed national borders, of obtaining information about market, developing, pricing and distributing any product. In a more general definition, international marketing includes performing all functions in many countries (Kırdar, 2005: 233). In addition that there is a relation between international trade and international marketing, terms used for both definitions are synonymous with each other. International trade involves various functions of marketing. But the big part of such a trade takes international marketing management out of context. With the statement of marketing management, the management of an international marketing programme for a firm is given, homewer, with the statement of world trade, it is stated that more, less or no active marketing management is practised, purchase and sale activities are included, and goods are exchanged more. As sale is a ring of marketing chain, export is a part of international marketing works. When a product made in the country is sent to abroad, foreign exchange, a currency having international validity enters in return for this, which leads to export. Services such as transportation, banking, construction presented on international market in return for foreign exchange are included in export (Kırdar, 2005:234). The first concept to be characterized about the enterance into international markets is export and export varieties. Export; is to determine potential customers within the market of another country, make sale of any product and let consumers have products. Indirect Export; is to export goods of an enterprise through mediators working in the country. Direct Export; is to realize export activities using various methods by themselves for enterprises. Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 3. Internatıonal Commercıal Terms (Incoterms®) When international commercial contracts are not designed as required, disagreements increase. In such legal relations, the parties which are present in different states and subjected to different legal systems, are encouraged to be stuck to permanent practices in order to minimize disagreements (Caner, 2012: 224). The efforts which were directed to organize different dimensions of international commerce started in England in the 19th century and took a shape there in the 20th century, obtained a peculiar type of legal regime. Incoterms® (International Commercial Terms) had a position based on the contract freedom in this regime, by means of being systematically updated, increasing its effects until today (Caner, 2012:224). Incoterms® eliminated possible problems between buyers and sellers when still in agreement and brought clarity to the parties’ rights and responsibilities (Özyavuz, 2012: 1). Incoterms® rules were designed in order to avoid possible disagreements from contracts due to different commercial implementations in effect within the parties’countries. (Caruntu and LapuduĢi, 2010: 99). The purpose of Incoterms® is to prevent misunderstanding each other while determining costs, risks and responsibilities on freight delivery for buyers and sellers (Murray et al. 2007: 10-11). When ICC (International Chamber of Commerce) put these rules into effect, it brought a newish approach to relations arranged in national legal norms. This development made the arrangement of international contracts simple, also became the first serious initiative for providing legal security of business proceedings. (Caner, 2012: 224). Incoterms® 2010 terms are shown at Table 1, as terms representing sellers’ responsibilities in export (departure) country and terms representing the end point for their responsibilities in import (arrival) country. Table 1: Incoterms®2010 – Delivery Responsibilities between Buyers and Sellers E Category EXW – (Ex Works) Departure F Category FCA – (Free Carrier) FAS – (FreeAlongsideShip) FOB – (Free on Board) Resource: Malfliet, 2011: 165 C Category CPT – (CarriagePaidTo) CIP – (CarriageandInsurance PaidTo) CFR – (CostandFreight) CIF– (Cost, InsuranceandFreight) Arrival D Category DAT – (Delivered At Terminal) DAP – (Delivered At Place) DDP – (DeliveredDutyPaid) Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 4. INCOTERMS® COSTS The other important point of Incoterms® rules is an item being for cost determination firstly considered by buyers and sellers. The first proceeding is to estimate costs while planning import and export. If this cost estimation is made correctly, the result from foreign trade becomes so right. As stated in the Incoterms® 2010 book, “Incoterms® regulates damage” (Incoterms, 2011: 10). Here, the point to be considered is duty distribution and just then cost share. Incoterms® rules determine risk and expense distributions associated with the proceedings for delivery of goods mentioned above. At Table 2, the risk and expense distributions are given in accordance with buyers and sellers. Table 2: Incoterms®2010 – Duty And Expense Distributions between Buyers and Sellers Resource: http://www.ucp600.info/files/incoterms2010_tablo_33.pdf, 2011: 1. When Incoterms® rules are put in order from the term means a seller having the least responsibility and cost to the term means a seller’s utmost responsbilities, firstly the term of “E” group is “EXW”, the terms of “F” group, the terms of “C” group follow this order, respectively, and the terms from “D” group are finally represented as “DDP”. Incoterms® terms set rules with regard to the transportation types of highway, airline, railway and maritime. There are total 11 delivery types classified into two main groups under Incoterms® 2010. As the first one of these groups is delivery types involving all transportation types (EXW, FCA, CPT, CIP, DAT, DAP, DDP), there are delivery types (FAS, FOB, CFR, CIF) including rules peculiar to maritime and intercoastal transportation in the second group. These delivery types are only used in maritime (Yılmaz et al., 2011: 3823). Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 5. Product Prıcıng Price is a materialistic value given on a product when considering product quality, its cost and image, market structure, competitors and consumers’ abilities to pay. In addition to this value, discounts, credits and payment conditions are dealt in the product price, and especially the delivery types in pricing export product and the costs regarding this are considered as well. (Ceran, 2009:166). Enterprises follow price policies based on costs, markets, competitions and decisions as a price policy. Cost accounting is included in pricing by providing important information about active price policies. A decision-based price policy is given at the following figure for marketing decisions based on cost information in terms of the marketing accounting relation (Ceran and Inal, 2004: 76-77). Figure1: Decision-Based Price Policy Cost-Based Price Policy Market-Based Price Policy DecisionBased Price Policy CompetitionBasedPrice Policy Resource: Ceran and Ġnal, 2004: 77. When analyzed the price policies, it is seen that the following pricing strategies are practised. 5.1. Cost-Based Pricing Profit per unit is diffrence between sale price and cost of a product. Pre-criteria of a product, cost and profit should not be for the marketing and sales department and any effect should not be on these items (Ceran and Ġnal, 2004: 77-78). Cost Plus Pricing and Target Pricing : In cost plus pricing, the sale price is determined adding a certain rate of profit into costs as a general formula. Cost = X Profit Rate= Y Possible Sale Price = X + Y For instance, for an export product (weeping pipe) having unit meter cost of 0,035 US dollars ($), the sale price will be 0,044$ with a profit rate of 30%. Here, the unit profit is 0,009$. In the above example, based on full cost, holding cost plus pricing, the sale price may be needed to be reduced in a competitive environment of market and on consumer reactions. If an enterprise needs to bring down the sale price below 0,040$ in accordance with market reactions and the profit margin remains to be same, the cost is mostly required to be 0,031$. The enteprise will consider production suitable for target cost by evaluating production processes and product designs. Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 5.2. Demand-Based Pricing In order to apply this method, the basic information for price-demand relations must be obtained (Ġslamoğlu, 2006: 340). Hereby, the main point is to determine what amount to be ssold at different prices (Badem and Fırat, 2011:88). 5.3. Competition-Based Pricing Cost based pricing and demand based pricing do not consider competition in market enough. For this reason, enterprises note cost and demand, and tend to determine prices based on competition (Ceran, 2009:175). In competition based pricing, an enterprise determines its price in accordance with the product position of rivals in target market (Ġslamoğlu, 2006: 341-342). Competition-based pricing is done when considering the prices of rivals in dependency on market (Ceran, 2009: 175-176). 5.4. Benefit-Based Pricing-Target Pricing (Price Minus Pricing) Target price, a method based on target cost is a pricing approach which becomes evident since traditional systems of cost accounting and traditional approach of cost plus pricing are not enough in making administrative decisions. Target pricing is based on the fact that prices are determined by market, not enterprises due to the changing conditions of competition (Ceran, 2009: 176). Price and benefit have a certain relation with each other. The highest benefit perceived by customers needs to exceed the highest price in competitive oriented comparison. This stuation can be formulated so; ∆Benefit / ∆Price > 1 (Ceran and Ġnal, 2004: 78). Achievable Price on Market (Target Cost ) - Target Profit (As % in Price ) = Target Cost 5.5. Benefit by the end-Based Pricing Service provider attempts to optimize having benefits from the full capacity with the usage of return management. This type of understanding includes pricing differentiation and suggests benefiting with still non-limited capacities to reduce prices (Ceran and Ġnal, 2004: 79). 6. Effect of Incoterms® Costs on Product Prıcıng 6.1. Relation between Incoterms® and Product Pricing In accordance with the distribution of Incoterms® costs, export costs are presented adding to the relevant product price and determining the sale price. After pricing policies are determined, the stage for the determination of sale price is started. This stage must include all costs from product cost at factory to price for consumers before clarifying the delivery type. All items must be considered in export price one by one and the sale price must be specified in accordance with Incoterms® costs. The items for export price are as follows (Benli, 2006: 31); a. Factory cost of product b. Profit of producer c. Packing and Marking (a+b+c) Ex-Works (Exw) Price d. Freight on factory e. Transportation to ports, railways, airlines or highway trailer/container fields Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 f. Fees for port, railway, airline, terminal usage g. Documentation fees (bill of lading etc.) h. Customs expenses (a+…+d+e+f+g+h) FOB price i. Insurance premium and draft expense j. International freight fees in maritime, airline, railway or highway transportation k. Fees for port, railway, airline, terminal usage (a+…….…+i+j+k) CIF price l. Discharge fees at arrival m. Customs taxes and other payments n. Fees of customs clearance o. Arrival to importer’s warehouse (a+…….…+i+j+k) DAT/DAP/DDP price 6.2. Pricing with Incoterms® Costs – Practical Applications For the weeping pipe to be exported from Turkey to Russia, considering export time, the reflection of Incoterms® costs on price is estimated. With target costing and target pricing policies, the delivery types are given in such a way in accordance with their costs for this export product having factory output price below 0,040$. Table 3: Estimation of Incoterms® Costs and Pricing – Practical Application-1 Incoterms® Costs Estimation and Pricing Incoterms® / Costs Unit Price Shipping to Target Cost 0,0300 $ Target Profit (30%) 0,0090 $ Product Factory Price 0,0390 $ Order Amount (metre) 1.850.000 Total Order Amount 72.150 $ Packing and Branding 1.100 $ Documentation Fees 20 $ (Etc:Certificate of Origin) Customs Consultancy and Bodies 150 $ Fees Sub Total 73.420 $ EXW / Konya-Turkey 0,0397 $ Freight (container) 80 $ Konya-Mersin Port shipment 870 $ Bill of Lading 65 $ Using port and free on board 275 $ Sub Total 74.710 $ FOB / Mersin Port 0,0404 $ International Freight 900 $ Insurance 250 $ Sub Total 75.860 $ CIF / Mersin Port 0,0410 $ Using arrival port and discharging 250 $ DAT/NovorossiyskSub Total 76.110 $ 0,0411 $ Russia Customs tax/ other expenses 15.222 $ Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 (approximately 20%) Internal shipment of import country (approximately) Sub Total 1.150 $ 92.482 $ DDP/ KrasnadorRussia 0,0500 $ Note: Freight for this export is done into a container at 40 ft High Cube dimensions. Shipment Route: This is realized in Konya-Mersin Port highway transportation tır containers, Mersin Port-Russia Novorossiysk Port maritime transportation container, Russia Novorossiysk-Krasnador highway transportation tır containers. Since the EXW delivery type of a product is a term related with the least cost for sellers, the lowest price is given in this term. A cost item for packing and branding given at table is included in production costs for this product. But packing and branding are regarded as separate cost items for some sectors and products, these are accepted in the costs of terms with “F”. In this example, for an enterprise which determines the sale price of factory with target cost under 0,040$ (0,0397$), the unit costs of a product are calculated in accordance with different types of transportation. The product costs over 0,050$ for an importer in Russia, and there is approximately a difference of 0,010$ (0,050$0,0397$) between unit cost and sale price of a product. The most important item in this difference is customs tax, other expenses and internal shipment in Russia with the cost of 0,009$ approximately, approximately the cost of 0,001$ is related with the shipment to Russia. The remarkable point is the effect of Incoterms® costs on unit costs. In such an export, the cost is nearly 0,001$ in accordance with CIF or DAT delivery types, its effect on unit product price is 2,6. When estimating costs, such an interest is made in export price, Incoterms® is determined and the offer is given to the customer. According to market reactions and competitive conditions, the number targeted as sale price of factory can be offered as the sale price of arrival country without including such a cost in sale price. In this regard, the targeted profitness will change in 30%. Since the cost will be over the targeted cost at 0,03$ approximately, the profit rate will be reduced to 25%, the unit profit will be 0,008$. Instead of the EXW delivery type of the target price, its determination in CIF or DAT delivery types will give competitive advantages, and customer reactions will be positive. But if the export volume is realized in small scales, not in such a scale, the effect of Incoterms® costs will be more sensible. Analyzing proceedings of an enterprise exporting the hydraulic automatic filtering system among irrigation systems seen in the following example, this situation can be explained. Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Table 4: Estimation of Incoterms® Costs and Pricing – Practical Application-2 Incoterms® Costs Estimation and Pricing Incoterms® / Costs Unit price Shipping to Cost 3.126 Profit (40%) 1.250 Product Factory Price 4.376 Order Amount (item) 4 Total Order Amount 17.506 $ Packing and Branding 320 $ Documentation Fees (Certificate 20 $ of Origin) Customs Consultancy and 150 $ Bodies Fees Sub Total 17.996 $ EXW / Konya-Turkey 4.499 $ Freight (container) 80 $ Konya-Mersin Port shipment 870 $ Bill of Lading 65 $ Using port and freight on board 275 $ Sub Total 19.286 $ FOB / Mersin Port 4.821 $ International Freight 3.950 $ Insurance 350 $ Sub Total 23.586 $ CIF / Mersin Port 5.896 $ Using arrival port and 250 $ discharging DAT/ SalvadorSub Total 23.836 $ 5.959 $ Brezilia Customs tax/ other expenses 4.767 $ (approximately 20%) Internal shipment of import 500 $ country (approximately) DDP/ SaoPauloSub Total 29.103 $ 7.276 $ Brezilia Note: Freight for this export is done into a container at 40 ft High Cube dimensions. Shipment Route: This is realized in Konya-Mersin Port highway transportation tır containers, Mersin Port-Russia Novorossiysk Port maritime transportation container, Russia Novorossiysk-Krasnador highway transportation tır containers. All procedings from Turkey to Brazilia are analyzed, and costs are estimated here. Since the sale price determined for free on factory by the enterprise is 4.500$, the enterprise has a profitness of 40%. In this situation, an offer can be given as a EXW price. All expenses except for this are undertaken by the buyer and total cost of the buyer is 7.276$. When Incoterms® FOB delivery type is determined for the same export in Turkey, the sale price is 4.821$, the changing ratio between the EXW price and FOB price is 7.17%, when Incoterms® CIF delivery type is also determined in Turkey, the sale price is 5.896$, the changing ratio between the EXW price and CIF price is 31,06%. When the delivery is done in Brezilia, the price for DAT term is 5.959$ and the EXW changing ratio is 32.45%, while taking on all expenses the Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 delivery price with the DDP term in Brazilia is 7.276$, the EXW changing ratio reaches at 61,72%. In this sample, cost unit resulting from Incoterms® responsibility distribution significantly affects price. When an exporter only considers his profitness without paying attention to an importer’s cost in such a sale proceeding, that person can face with the refusal of an offer. The importer tends to closer markets or alternative products in order to reduce his costs since the cost of product is higher than the sale price of factory. The enterprise can make target pricing by taking Incoterms ® costs and sale prices of buyers on market into consideration with a view to preventing this situation. Supposing that the price or the actual cost acceptable for market or buyers is 6.500$, a discount of 776$ should be performed in the estimated DDP price of 7.276$ of including all expenses. In accordance with the FOB delivery types, the price will be given as 4.046$ instead of 4.821$ if any price is required from the enterprise. Target pricing will provide advantages to enterprises for competition on market. But an enterprise needs reviewing target profitness and target costing with this reduction. If the cost remains the same, the possible profit will approximately reduce to 15%. If an enterprise wants to continue target profit as 40%, the cost will be 2.350$. Improvements with target costing will be at the rate of 25% approximately. In such a situation, an enterprise will use the methods of target costing in items affecting cost by considering all production processes. 7. Conclusıon The situation of price determination is a complex process since it is affected by many factors in international markets. These factors are consumer behaviors, competitive situation, firms’ own cost structures and profit targets, government applications. When fluctuations in exchange ratios are added into these factors, the pricing proceedings are put into consideration for firms and always followed by them. Interaction of pricing decision with other marketing elements is a remarkable situation. According to this, marketing mix elements such as distribution channels, product characteristics, description and promotional works must be considered, in addition to the elements such as firm targets, costs, demands, competitions, government policies, customs taxes and other taxes, inflation and product line. Providing that all these considerations are made, it is observed that Incoterms® responsibility distribution and costs have effects on the price policy in market. Whereas enterprises must dominate on all export processes, they must participate in price competition on market knowing the necessities of Incoterms® rules. Target pricing as market based pricing and optimal benefit with the help of target costing resulting from this should not be regarded not only in production process but also in all cost items. Some cost items which are confronted from the departure of factory to the arrival of goods to customers. Some cost items such as customs proceedings, taxes, etc. taken because of the Incoterms® term are out of control for enterprises. But target costing can be achieved in cost items such as international Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 freight, insurance, mediating services, etc. except for these. For long-term and periodical shipments, the costs of subscription shipment and insurance prices can be reduced, the desirable costs can be obtained by increasing varieties of offer and taking appropriate prices from mediators, shipping agents, firms providing consultancy service in a competitive environment. References BADEM C., ve FIRAT, D., (2011), “Temel Pazarlama BileĢenleri Açısından Muhasebe Verilerinin Kullanılması: Pazarlama Muhasebesi”, Kocaeli Üniversitesi Sosyal Bilimler Enstitüsü Dergisi (21) 2011/1:77-101. BENLĠ A., O., (2006), “Ġhracatta Fiyatlandırma Ve Teklif Hazırlama” ĠGEME- Ġhracatı GeliĢtirme Etüd Merkezi, Temmuz. CANER, O., (2012) “Incoterms®2010 (Icc Rules ForTheUse Of DomesticAndInternatıonalTradeTerms)”, Ġstanbul Ticaret Üniversitesi Sosyal Bilimler Dergisi Yıl:11 Sayı: 22 Güz 2012/2 s.223- 262. CARUNTU, C. ve LAPADUġĠ, M., L., (2010), “ComplexIssuesregardingthe Role andImportance of InternationallyCodified Rules andIncoterms” PetroleumGasUniversity of Ploiesti, EconomicSciences Series, Bulletin, Sayı: LXII, No. 1/2010, s.98–110. CERAN, Y., (2009), “Maliyet Bilgilerine Dayalı Stratejik Pazarlama Kararları Ġçin Stratejik Pazarlama Muhasebesi” Tablet Yayınları, II. Baskı, Konya. CERAN, Y., ve ĠNAL, M., E., (2004), “Maliyet Bilgileri Temeline Dayalı Pazarlama Kararları Ġçin Pazarlama Muhasebesi”, Erciyes Üniversitesi Ġktisadi Ve Ġdari Bilimler Fakültesi Dergisi, Sayı: 22, Ocak-Haziran 2004, s.63-83. ENGĠN, Ediz, (2005), “ĠĢletmelerin Uluslararası Rekabet Stratejileri Ve Uygulamalı Bir AraĢtırma” Yüksek Lisans Tezi, Ekim. INCOTERMS®2010, (2011), “ICC Rules fortheuse of domesticandinternationaltradeterms”, ICC Publication No. 715E, Paris. International Chamber of Commerce. (2010), Incoterms®2010:Yayın No.715 (Çev. Ercüment Erdem), Ankara. ĠSLAMOĞLU, Ahmet H., (2006), Pazarlama Yönetimi, 1. Baskı, Beta Basım Yayım Dağıtım A.ġ., Ġstanbul. KAHVECĠ, E., (2011), “Incoterms 2010 Ġle Getirilen DeğiĢiklik Ve Yenilikler”, http://www.dunya.com/incoterms-2010-ile-getirilen-degisiklik-ve-yenilikler116659h.htm, (EriĢim Tarihi: 15.12.2012). KAYA, F., (2011), “DıĢ Ticaret ĠĢlemleri” Beta Yayınları 2.baskı. KIRDAR, Y., (2005), “DıĢ Pazarlara Yönelme Nedenleri Ve Stratejileri”, Sosyal Bilimler Dergisi, http://yordam.manas.kg/ekitap/pdf/Manasdergi/sbd/sbd13/sbd-1321.pdf (EriĢim Tarihi: 15.12.2012). MALFLIET, J., (2011), “Incoterms®2010 andtheMode of Transport: How toChoosethe Right Term”. http://biblio.ugent.be/input/download?func=downloadFile&fileOId=1212631,(EriĢim Tarihi: 17.12.2012). MURRAY, C., HOLLOWAY, D., TIMSON-HUNT, D. ve SCHMITTHOFF, C., M., (2007), “Schmitthoff’sExportTrade. TheLawandPractice of International Trade”, 11. Baskı, Londra, s.10-11. Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 ÖZYAVUZ, Y., (2012), “Incoterms Kurallarının Malıyet Hesapları UzerındekıRolu” http://yalcinozyavuz.blogcu.com/incoterms-kurallarinin-maliyet-hesaplari-uzerindekirolu/13225426 (EriĢim Tarihi: 04.12.2012). UN/CEFACT, (2001), “CodesforModes of Transport” Recommendationno. 19 (secondedition), http://www.unece.org/cefact/recommendations/rec19/rec19_01cf19e.pdf, (EriĢim Tarihi: 13.12.2012). YILDIZTEKĠN, Ġ., (2009), “Hedef Maliyetlemede Ürün Fiyatını Belirleme”, Atatürk Üniversitesi Ġktisadi Ve Ġdari Bilimler Dergisi, Cilt: 23, Sayı: 2. YILMAZ, M., ÖZKEN, A. ve ġAHĠN, N., (2011), “Incoterms 2000 Ve 2010’un Mukayeseli Analizi Ve Türkiye Uygulamalarındaki Eksiklikler”, Journal of Yasar University, Sayı:23(6), s.3814-3825. http://www.iccwbo.org/policy/law/index.html?id=38880,2011, (EriĢim Tarihi: 10.10.2012). http://www.ucp600.info/files/incoterms2010_tablo_33.pdf, 2011, (EriĢim Tarihi: 02.12.2012).